Trump to Scrap Critical Health Care Subisies Hitting Obamacare Again

CBO report on the Bipartisan Health Care Stabilization Act of 2017

The Bipartisan Health Care Stabilization Act of 2017 (colloquially known equally the Alexander-Murray bill) was a 2017 proposed compromise reached by Senator and Help Committee Chairman Lamar Alexander and Senator and HELP Committee Ranking Member Patty Murray to amend the Affordable Care Act to fund cost-sharing reductions subsidies.[one] The program will also provide more flexibility for state waivers, permit a new "Copper Plan" or catastrophic coverage for those under 30, allow interstate insurance compacts, and redirect consumer fees to states for outreach. President Trump had stopped paying the cost sharing subsidies and the Congressional Upkeep Office estimated his action would cost $200 billion, cause insurance sold on the exchange to cost 20% more and cause one meg people to lose insurance.[ii]

Background [edit]

The CSR subsidies are paid to insurance companies to reduce copayments and deductibles for a smaller group of ACA enrollees, those earning less than 250% of the federal poverty line (FPL). They are meant to reduce the toll for enrollees in this income bracket that are on silverish plans while increasing the actuarial value of the plans. For example, in 2016 the maximum out of pocket for an private on a silverish program was $6,850, but for individuals with an income up to 200 percent of the FPL, that maximum cost was reduced to $2,250. Simultaneously, these CSR payments were able to increase the actuarial value of a silver plan from 70 percent to 87 percent for those with incomes between 150 and 200 percentage of the poverty line. 56 percent of all marketplace enrollees were receiving CSRs as of 2015.[3]

Premium taxation credits are the other main subsidy in the ACA, representing a much larger portion of ACA spending, and they were designed to reduce the mail service-subsidy price of monthly premiums, apply to all enrollees earning less than 400% of the FPL. For scale, during 2017, approximately $7 billion in CSR subsidies will be paid, versus $34 billion for the premium tax credits.[4]

Nether the Obama assistants, these cost sharing reduction payments were paid out because the Section of Health and Homo Services argued that the premium tax credits and the cost sharing reductions were "economically and programmatically integrated" in the Affordable Care Act, and then the appropriation that covers the premium tax credits also allowed HHS to pay CSR payments. Nonetheless, the Firm of Representatives sued the Administration over this, arguing that the lack of an explicit appropriation for CSRs means that the payments can not exist made. The decision in this case, House of Representatives v. Burwell, was that CSRs required a specific cribbing, only stayed any cancellation of CSR payments if and when appeals to the decision were made. The arguments made in this case became the backdrop for why the Trump Administration would cancel these payments.[3]

Trump Administration actions on CSRs [edit]

On October 12, 2017, after months of speculation, the Trump Administration appear that they were discontinuing the price sharing reduction payments, claiming that the payments were unconstitutionally circumventing the legislative appropriations process.[v] This was amidst the actions taken by President Trump to start to dismantle the Affordable Care Deed afterward Congress had failed to repeal it earlier in 2017. Trump had received warnings against this movement from members of both parties, including 1 Republican senator who told him that the Republican Party would effectively "ain health care" as a political consequence if the president cancelled the CSR payments, just he moved frontwards with it anyway.[6]

CBO estimate of impact of ending CSR payments [edit]

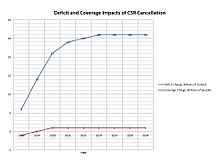

CBO projected impacts of counterfoil of CSR payments on the federal deficit and wellness insurance coverage[vii]

The CBO reported in August 2017 (prior to President Trump's decision) that catastrophe the CSR payments would increment ACA premiums by about twenty percentage points in 2018, with a resulting increase of near $200 billion in the budget deficit over a decade, as the premium taxation credit subsidies would rise along with premium prices to cover the boosted costs not subsidized by the CSRs. CBO also estimated that initially up to one one thousand thousand fewer would take wellness insurance coverage, although coverage may increase in the long-run as the premium subsidies increment. This initial drop would be due in part to the fact that insurers would leave some markets due to the instability and chance of unknown costs, leaving about five percent of people living in areas with no insurers in 2018. CBO expected the exchanges to remain fairly stable (e.g., no "expiry spiral") as premiums would increase and prices would stabilize at the college (non-CSR) level.[seven]

CBO estimated that of the 12 million with private insurance via the ACA exchanges in 2017, about 10 meg receive premium tax credit subsidies and will be shielded from premium increases, as their after-subsidy premiums are limited as a percentage of income under the ACA. However, those 2 million who do not receive subsidies confront the brunt of the 20%+ premium increases, without subsidy aid. This may adversely bear upon enrollment in 2018 and across. Another 13 one thousand thousand who are at present covered nether the ACA's Medicaid expansion (in the 31 states that chose to expand coverage) should not be directly affected by the President's action.[seven] [four]

Alexander-Murray negotiations and bill [edit]

Although the Trump Assistants did not officially cancel the CSR payments until mid-Oct 2017, he had been talking about doing so long earlier, and then at that place were already ongoing negotiations between Senator Lamar Alexander (R-TN) and Senator Patty Murray (D-WA), the Chair and Ranking Member of the Senate Wellness, Education, Labor and Pensions Committee, to try to observe a bipartisan solution to the looming trouble. These negotiations had to exist put on concur for much of September 2017 every bit Republicans made one last attempt to repeal and supercede the Affordable Care Act, but when the Graham-Cassidy nib failed, these negotiations quickly restarted again.[8] Somewhen, Alexander and Murray did reach an agreement on the outline of a plan. The bill included funding of CSR payments for two years, as well as additional funding to assistance marketing of the enrollment menstruation for the ACA. It made it easier for states to receive 1332 waivers, without allowing states to circumvent the ACA's essential health benefits, and also allowed for people under thirty to purchase catastrophic wellness insurance plans, often chosen 'copper' plans for their depression actuarial value.[9] The nib apace received 24 bipartisan cosponsors, including Sen. Susan Collins (R-ME), Sen. Lisa Murkowski (R-AK), Sen. Joe Donnelly (D-IN) and Sen. Joe Manchin (D-WV).[10] However, the nib faced a murky political future due to opposition from Republican leadership in both chambers of Congress.

CBO estimate on bill [edit]

The CBO reported on 25 October 2017 that the bill would end up cutting the deficit past $3.8 billion. While the CBO estimate of the bill did not wait it to substantially change the number of people on health insurance on cyberspace, this was by and large because the CBO baseline that they were comparing the policy changes in the legislation to already included the CSR payments that were being returned in the Alexander-Murray bill. The expanded state waiver flexibility would result in increased costs, only this would be brought down by the restoration of CSR payments too as the addition of "copper" tier plans.[xi] [12]

Function of Alexander-Murray in broader political debate [edit]

The timing of the Alexander-Murray understanding had a major role in the difficult path to passage for the bill, every bit the bargain was announced simply every bit the Republican push for tax reform, which would soon become the Tax Cuts and Jobs Act of 2017, was gaining steam. The legislative calendar at the time looked fairly full, and and then it quickly became clear that passage of Alexander-Murray would have to come every bit part of some larger agreement.[9] Senator Susan Collins, one of the cosponsors of the bill, had serious concerns well-nigh the taxation legislation, particularly regarding the repeal of the Affordable Care Act'due south individual mandate in the tax bill. In order to assistance compensate for what she saw as poor healthcare policy, she made Senate Republican Leadership promise to pass Alexander-Murray, among other pieces of healthcare legislation.[13] Even so, Majority Leader Mitch McConnell was unable to keep his promise and never passed Alexander-Murray, as of May 2018.[14] However, Collins' vote was crucial to pass the tax bill through the Senate with the thin majority Republicans had.

References [edit]

- ^ Thomas Kaplan and Robert Pear. "two Senators Strike Bargain on Health Subsidies That Trump Cut Off".

{{cite news}}: CS1 maint: uses authors parameter (link) - ^ "CBO says Trump'southward Obamacare sabotage would cost $194 billion, drive up premiums 20%". Vox . Retrieved 2017-10-17 .

- ^ a b Jost, Timothy (May 12, 2016). "Guess Rules Against Administration In Cost-Sharing Reduction Payment Case". Health Affairs. doi:10.1377/forefront.20160512.054852.

- ^ a b CBO-Federal Subsidies for Health Insurance Coverage for People Nether Age 65: 2017 to 2027-September 14, 2017

- ^ "Trump Assistants Takes Action to Abide past the Law and Constitution, Discontinue CSR Payments". HHS.gov. 2017-x-12. Retrieved 2018-03-05 .

- ^ Pear, Robert; Haberman, Maggie; Abelson, Reed (2017-10-12). "Trump to Flake Disquisitional Health Care Subsidies, Hitting Obamacare Again". The New York Times. ISSN 0362-4331. Retrieved 2018-03-05 .

- ^ a b c CBO-The Effects of Terminating Payments for Toll-Sharing Reductions-August fifteen, 2017

- ^ Haberkorn, Jennifer; Everett, Burgess (September 28, 2017). "Alexander, Murray inching toward deal to stabilize Obamacare". Pol . Retrieved 2018-03-07 .

- ^ a b Haberkorn, Jennifer (October 17, 2017). "Alexander, Murray strike bipartisan Obamacare deal providing subsidies, state flexibility". Political leader . Retrieved 2018-03-07 .

- ^ "Alexander and Murray announce 24 co-sponsors of bipartisan Obamacare fix". Oct 19, 2017. Retrieved 2018-03-07 .

- ^ Beaton, Thomas (26 October 2017). "CBO: Alexander-Murray Healthcare Bill Could Salvage $3.8B". HealthPayerIntelligence.com . Retrieved 26 Oct 2017.

- ^ "Bipartisan Health Care Stabilization Human action of 2017" (PDF). Congressional Budget Role. Archived from the original (PDF) on 25 October 2017. Retrieved 26 October 2017.

- ^ Nilsen, Ella (December 20, 2017). "Key senators sold their votes on the tax bill for some loftier-risk deals". Vox . Retrieved 2018-03-07 .

- ^ Swanson, Ian (2017-12-20). "Collins lets McConnell slide on promise to shore up insurance markets in 2017". TheHill . Retrieved 2018-03-07 .

Source: https://en.wikipedia.org/wiki/Bipartisan_Health_Care_Stabilization_Act_of_2017

0 Response to "Trump to Scrap Critical Health Care Subisies Hitting Obamacare Again"

Post a Comment